How RBA Governor Philip Lowe sees the year ahead

- Written by Isaac Gross, Lecturer in Economics, Monash University

Reserve Bank Governor Philip Lowe has painted an optimistic view[1] of where the Australian economy is heading after a turbulent 2021.

Just how crazy last year was is highlighted by the differences between the bank’s forecasts at the start of last year and what has actually happened.

Despite the Delta and Omicron waves of COVID, which were unexpected and knocked things around, economic growth has been much higher and unemployment much lower than expected in February 2021.

The bank expected economic growth of 3.5% and might have got 5%. It expected unemployment of 6% and got 4.2%.

It has been a superb economic performance, offset by a higher than expected inflation with a headline rate of 3.5%.

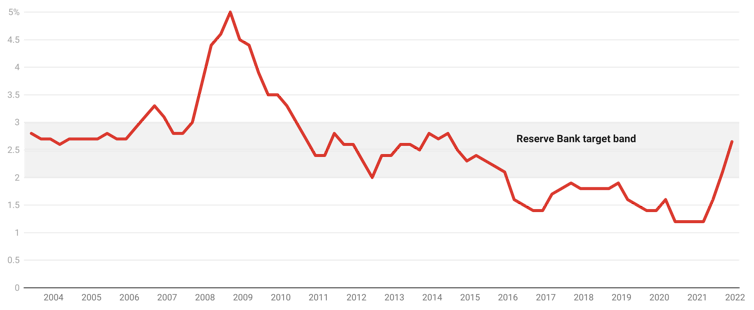

While this looks as if we might be on the road to the high inflation seen in the rest of the developed world (in the US inflation is 7%), at a touch under 2.7% Australia’s so-called underlying rate of inflation is much lower than in the US, UK or New Zealand. It also happens to be in the middle of the bank’s 2-3% target band.

This might be because inflation has been well below the Reserve Bank’s target band for the past half decade.

Underlying inflation

Addressing the National Press Club on Wednesday, Philip Lowe said he expects[3] Australia’s gross domestic product to continue growing at a rapid rate in the year ahead, around 4.5%. He also sees unemployment to continue falling – down to as little as 3.75% by the end of this year.

He expects underlying inflation to peak at just over 3%, before returning to the 2-3% target band.

Better than before

What explains this optimistic outlook? In many ways, the economy of 2022 resembles a return to normality.

Experts expect the Omicron wave to continue to diminish and the rollout of vaccine boosters and new anti-viral drugs to push COVID into Australia’s rear-view mirror.

This means Australia slowly returning to its pre-pandemic state with open borders and no lockdowns and restrictions.

It would also mean returning to the sub-par economic growth of 2-2.5% we had before COVID, were it not for two things.

One is what the crisis did in forcing the government to end its budget surplus fetish and spend to support the economy.

The other is what it did in persuading the Reserve Bank to rekindle its pursuit of full employment.

Before the pandemic, the bank worried excessively about the risks low interest rates posed to financial stability. Today, it rightly prioritises supporting the labour market.

These twin developments mean the 2022 economy is being supported by two coordinated boosters.

Combined, monetary (interest rate) stimulus and fiscal (budget spending) stimulus has pushed the unemployment rate well below 5% and will continue pushing it down over the months to come.

Read more: Unemployment below 3% is possible for the first time in 50 years – if Australia budgets for it[4]

Dr Lowe finished his speech turning to monetary policy and how it might unfurl over the year to come.

The bank has finished[5] its use of unconventional monetary policies - bond-buying measures such as “yield curve control[6]” and “quantitative easing[7]”. But it remains committed to keeping its cash rate at the current low of 0.1% for a while yet.

So why keep interest rates low?

Why keep interest rates so low if the outlook is so positive? The governor put forward two reasons.

One is that, while the bank has an optimistic outlook for 2022, there is still a great deal of uncertainty around what the year will bring.

The bank wants to make sure these gains are locked in before it takes its foot off the accelerator. The costs of overheating the economy are relatively minor compared to what would happen if it hit the brakes too early and a new variant of COVID tipped the economy back into a recession.

Read more: Top economists expect RBA to hold rates low in 2022 as real wages fall[8]

The second is that wage growth remains very weak. The economy won’t be on a stable upward trajectory until wage growth picks up from its historic lows.

Although the bank expects wage growth to lift, it believes it will be a while yet before it climbs above the minimum of 3% needed to keep inflation within the target band.

Australia’s economy survived 2021 better than most expected. On Wednesday, Dr Lowe gave us good reasons to believe that this year it will do better still. And he has committed the bank to supporting households and businesses to try and ensure it does. He wants to deliver on his great expectations.

References

- ^ painted an optimistic view (www.rba.gov.au)

- ^ ABS (www.abs.gov.au)

- ^ expects (www.rba.gov.au)

- ^ Unemployment below 3% is possible for the first time in 50 years – if Australia budgets for it (theconversation.com)

- ^ finished (www.rba.gov.au)

- ^ yield curve control (www.rba.gov.au)

- ^ quantitative easing (www.rba.gov.au)

- ^ Top economists expect RBA to hold rates low in 2022 as real wages fall (theconversation.com)