Business is trying to scare us about 'same job, same pay'. But the proposal isn't scary

- Written by Gemma Beale, Senior Project Officer, Australian Industrial Transformation Institute, Flinders University

On Monday, eight of Australia’s largest employer groups launched a campaign against the government’s Same Job, Same Pay Bill[1], saying it was “unfair”.

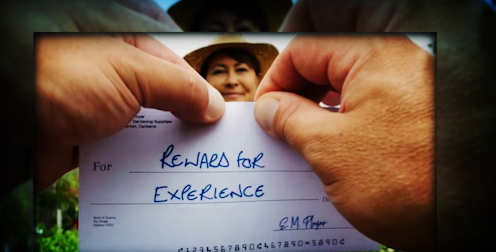

The television ads and website[2] say the proposed law would penalise hard workers with “decades of knowledge and experience” by forcing employers to pay everyone the same (in the hard workers’ case, lower) wage.

Minerals Council of Australia advertisement.The employer groups are right about one thing. What’s at stake is fairness, although not in the way they suggest.

The bill, introduced in November, is designed to regulate the disingenuous use of labour-hire contracts[3].

Its explanatory memorandum says its aim is to “ensure that workers employed through labour-hire companies will receive no less than the same pay as workers employed directly”.

It does this in two ways.

labour-hire businesses would be required to afford to all workers whom they provide to another person “pay and conditions which are no less favourable” than those required to be paid to direct employees of that person

firms or people that use labour-hire businesses would be required to provide the labour-hire business with all the information it would reasonably require to comply with the act and to refrain from engaging any labour-hire business that did not comply with the act.

The bill is part of an election promise Labor made to address instances of employers using labour-hire firms to deliberately undercut the wages and conditions they offer in enterprise agreements.

Labor hire isn’t all bad

Many labour-hire arrangements are put in place for legitimate reasons.

Among the examples are aged-care workers contracted through an external agency to backfill sick leave and production workers contracted to deal with unexpected increases in demand.

In the preamble to the bill, the government explicitly says it will not affect the ordinary and fair use of labour hire, including as a reasonable way to manage surge periods and employee absences.

But the misuse of labour-hire agreements is contributing to the fracturing of Australian workplaces by setting up two – and sometimes more – sets of employment conditions, which is inherently unfair.

But labour-hire workers can be poorly paid

The Bureau of Statistics finds 84% of workers on labour-hire contracts don’t have access to paid leave entitlements. Their median annual earnings are A$33,100. Labour-hire work is insecure and poorly compensated for being insecure.

Labour-hire workers are also more likely to sustain workplace injuries due to inadequate training and management practices.

In November the South Australian Employment Tribunal found in favour of a worker who was “not trained adequately or at all in relation to the safe completion of the task” that resulted in their death.

Read more: The costs of a casual job are now outweighing any pay benefits[4]

The employers’ groups campaigning against the Bill include the Australian Chamber of Commerce and Industry, the Australian Petroleum Production & Exploration Association, the Business Council of Australia and the Council of Small Business Organisations.

They also include the Minerals Council of Australia headed up by Tania Constable who told 2GB’s Ray Hadley[5] on Monday the bill would mean someone could “be employed by a business for six months and get the same pay as somebody that has been there for six years”.

The bill does not require every worker to be paid the same

The bill does not relate to the rates of pay within organisations. What it would do is require labour-hire firms to provide pay and conditions “no less favourable” than those paid to direct employees performing the same duties.

It would not change or override anything in enterprise agreements.

The employers groups have also claimed the bill would suppress wage growth[6] when the opposite is more likely to be true.

Fragmented workplaces and the low wages common in insecure contracts (including labour-hire agreements) have been exerting a downward pressure on Australian wages.

It is more likely to lift than depress wages

Rather than lowering permanent employees’ wages, the bill would lift the wages of labour-hire workers up to their level.

Claims that it would disincentivise hard work or hurt productivity (or cost jobs[7]) obscure what the bill is about: ensuring workers who are doing the same job go home with the same paycheck at the end of each day.

The government will put the bill before parliament later this year.

It is worth considering what the motives might be of those who oppose it. It might be that they are not as keen to increase wages, productivity and employment as they say and are more concerned about keeping the right to pay externally hired contractors less than the workers they work alongside.

References

- ^ Same Job, Same Pay Bill (www.aph.gov.au)

- ^ website (www.findabetterway.com.au)

- ^ labour-hire contracts (www.corrs.com.au)

- ^ The costs of a casual job are now outweighing any pay benefits (theconversation.com)

- ^ Ray Hadley (omny.fm)

- ^ suppress wage growth (www.findabetterway.com.au)

- ^ cost jobs (omny.fm)