How to get both JobKeeper and JobSeeker

- Written by Brendan Coates, Program Director, Household Finances, Grattan Institute

At A$1,500 a fortnight, JobKeeper[1] has been nothing but a help to the people on it.

The rules required those who had previously been paid more than JobKeeper to stay on their old wage, with the rest topped up by their employer. Those who had previously been paid less (one quarter of them) got a pay rise.

It’ll be less rewarding from the end of September. That’s when it’ll fall to $1,200 per fortnight for people who had previously been working 20 hours or more hours per week, and $750 per fortnight for people who had previously been working less than that.

Read more: Bowing out gracefully: how they'll wind down and better target JobKeeper[2]

At the same time, the temporary coronavirus supplement[3] paid to Australians on JobSeeker and other benefits will fall from $550 a fortnight to just $250.

Those receiving only the full-time JobKeeper rate can expect their incomes to fall by 20%. Those on the part-time rate can expect their income to halve.

But the good news is that at least some will be able to top up their incomes by applying for JobSeeker.

JobKeeper and JobSeeker

Many will be able to apply to recieve both.

They will need to satisfy the assets test[4] for JobSeeker, which is being re-imposed from September 25. It will deny JobSeeker to single homeowners with assets of more than $268,000 in addition to their home, and to single non-home owners with assets of more than $482,500.

They would also need to wait for a reimposed liquid assets waiting period[5] of between one and 13 weeks, depending how much money they have in their bank accounts.

Their partners would need to earn less than $3,068 a fortnight[6], or roughly $80,000 a year.

And they will be required to make at least one phone or online appointment per week with an employment services provider.

Up to $554 on top of JobKeeper

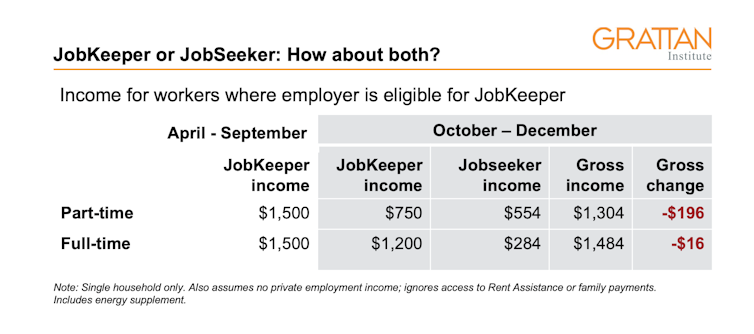

Our calculations suggest that under the new rules from late September, such a person on the part-time JobKeeper rate of $750 a fortnight should be able to claim up to an extra $554 in JobSeeker – taking their total income to $1,304 per fortnight – only $196 per fortnight less than they got when JobKeeper was $1,500 per fortnight.

It gets better. Even people getting the new lower full-time JobKeeper rate of $1,200 per fortnight will be able to get some JobSeeker if they fit through the hoops.

Our calculations suggest they will be eligible for up to $284 per fortnight JobSeeker top-up, taking their total income to $1,484 for fortnight, only $16 per fortnight less than they are receiving now.

Grattan Institue calculations.

Grattan Institue calculations.

It gets better still. If they pass through the hoops, they will also become eligible for other benefits such as a Commonwealth Health Care Card, Family Tax Benefit part A if they have kids, and rent assistance if renting.

The treasury believes 245,000 Australians will be on both JobKeeper and JobSeeker by the end of the year.

You’ll have to apply

One of the virtues of the original JobKeeper was that, from the point of view of the recipient, it was automatic[7]. Once their employer decided to apply for it, there was nothing else they needed to do.

As JobKeeper is phased down and JobSeeker returns to its traditional role of supporting Australians on low incomes, there will be a lot more they need to do.

Some won’t bother, and some won’t succeed, but at least until the end of the year it’ll be possible for some Australians on JobKeeper to get more or less what they were getting before.

It’s less good for those pushed out of work

It’s worth sparing a thought for those that will lose their jobs as JobKeeper winds down.

In October, employers wanting to stay on JobKeeper will have to be retested and approved, and in January retested and approved again.

Read more: JobSeeker supplement cut from $550 to $250 a fortnight after September[8]

Many will miss out. Retesting is expected to reduce the number of workers on JobKeeper by 60% over the last three months of this year and by a further ten percentage points over the first three months of next year.

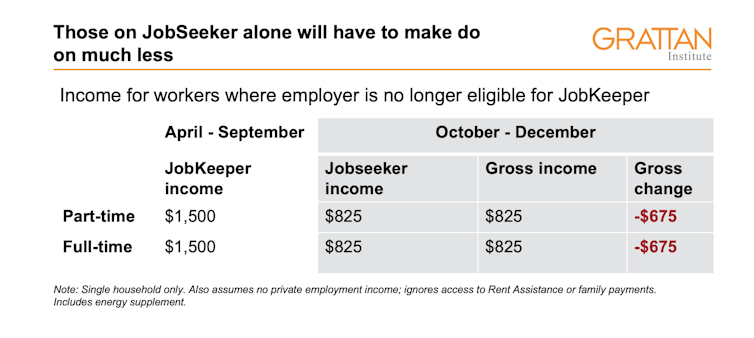

If those whose lose JobKeeper also lose their jobs — and many will — they’ll have to make do with the much lower JobSeeker payment of about $825 a fortnight, not much more than half of the $1,500 a fortnight they had.

Grattan Institue calculations.

Grattan Institue calculations.

Treasury expects 1.5 million people[9] to be on JobSeeker by the end of the year.

It expects some 245,000 to recieve both JobSeeker and JobKeeper. That will leave around 1.25 million to get by on the lower JobSeeker alone.

References

- ^ JobKeeper (treasury.gov.au)

- ^ Bowing out gracefully: how they'll wind down and better target JobKeeper (theconversation.com)

- ^ coronavirus supplement (treasury.gov.au)

- ^ assets test (www.servicesaustralia.gov.au)

- ^ liquid assets waiting period (www.servicesaustralia.gov.au)

- ^ earn less than $3,068 a fortnight (www.servicesaustralia.gov.au)

- ^ automatic (theconversation.com)

- ^ JobSeeker supplement cut from $550 to $250 a fortnight after September (theconversation.com)

- ^ 1.5 million people (www.afr.com)

Authors: Brendan Coates, Program Director, Household Finances, Grattan Institute

Read more https://theconversation.com/how-to-get-both-jobkeeper-and-jobseeker-143109