Grade A Office Rental Decline Slowed and Expected to Stabilize in 2H 2022 Retail Sentiment Recovered, F&B Operators Stayed Active

Medical, sports and wellness sectors to become the new growth drivers of the post-pandemic leasing market

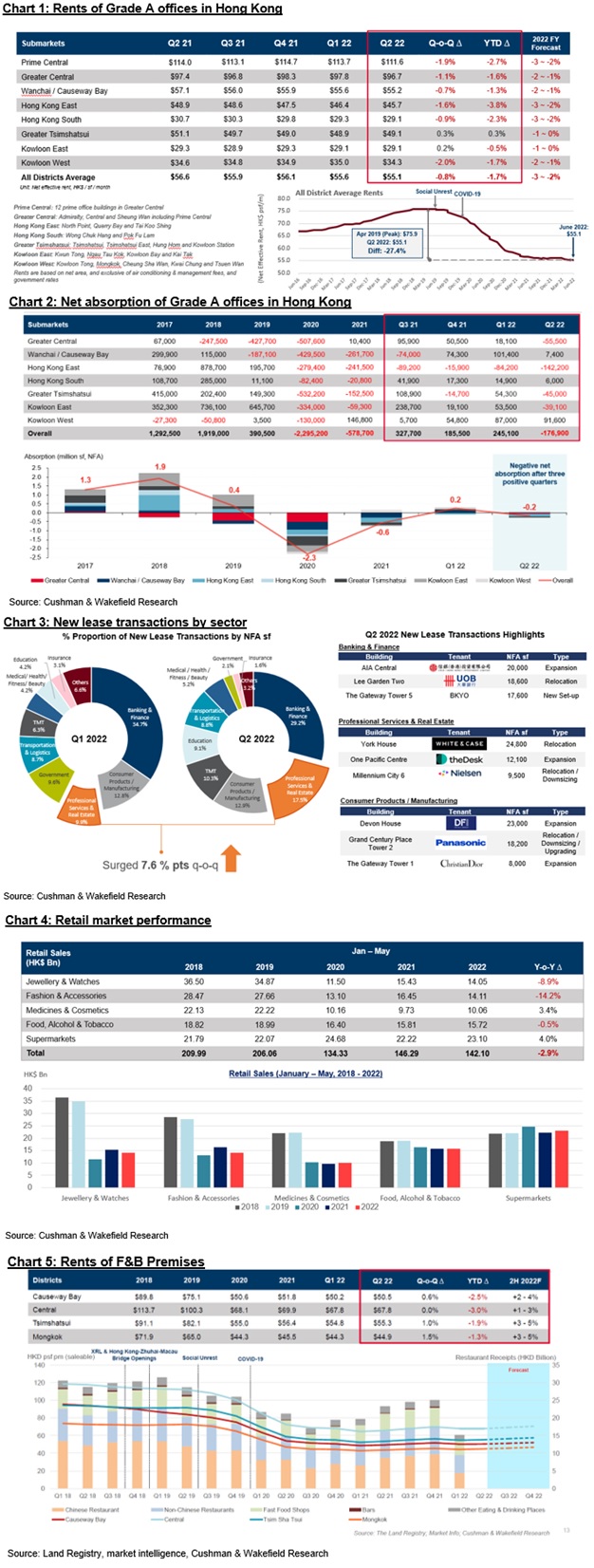

- Overall Grade A office rental level in Q2 2022 fell by 0.8% q-o-q, slightly less than the 0.9% q-o-q drop seen in Q1, with a 2022 full-year decline now predicted at 2% to 3%

- Increased demand from the healthcare and medical aesthetics sector, together with serviced offices and co-working space operators, is now expected to be new drivers of office absorption.

- Despite the overall retail market remaining weak, vacancy rates have lowered while rental decline narrowed compared to last quarter.

- Rent for F&B outlets is expected to rise by 1% to 5% in 2H 2022, offsetting the decline from January to June. Overall F&B rental level for 2022 is expected to remain stable.

HONG KONG SAR - Media OutReach - 7 July 2022 - Global real estate services firm Cushman & Wakefield today published its Hong Kong Office and Retail Leasing Markets Review and Outlook Q2 2022 report. With the easing of the fifth wave of the pandemic since April, office market leasing activity has gradually recovered, and the retreat in Grade A office rent has moderated again, at 0.8% q-o-q. Mild negative absorption has been recorded, pushing availability slightly upwards. On the other hand, overall performance in the retail market has been relatively weak, with dampened total retail sales in the first five months of 2022. Overall rental levels in major retail districts have remained steady. The lifestyle products, sports and wellness sectors have grown amidst the pandemic period and emerged as new drivers in the domestic retail market. Consumer confidence is expected to recover gradually as a result of a new round of the Consumption Voucher Scheme, stimulating retail leasing activities in 2H.

Office market – Rental decline slowed, availability rose after three consecutive quarters of falls

Despite slow progress in the global and local economic recoveries, the leasing market was relatively active in Q2 2022. The overall office rental level decline further narrowed at 0.8% q-o-q (vs. 0.9% q-o-q in Q1) and has now fallen 1.7% in the year-to-date for the first half of 2022. By submarket, Hong Kong East and Kowloon West experienced steeper drops in rents at 1.6% q-o-q and 2.0% q-o-q respectively (Chart 1). Office rents in Hong Kong have now plunged by more than 27% from their peak in April 2019, standing at a relative bargain level, particularly in the core CBD areas predominately occupied by banking and financial institutions. Non-core areas have also continued to attract tenants with expansion and cost-saving opportunities. We now expect to see a rental reduction of 1% to 2% in the 2H 2022 period, while the recovery is expected to be led by the core CBD districts.

Given the previous three consecutive quarters (Q3 2021 to Q1 2022) of positive net absorption, this has demonstrated that tenants have taken advantage of bargain-level rents and proactively executed their leasing decision-making via relocation or upgrading.

Despite a good number of new leasing deals recorded in Q2, expired/ expiring leases in the quarter increased available space, pushing down total net absorption to -176,900 sq ft q-o-q (Chart 2). In terms of new leasing transactions by sector, the banking and finance sector took up the most floor area (29%), followed by professional services and real estate (17.5%) which notably outperformed with an increase of 7.6% percentage points q-o-q. The consumer products and manufacturing sectors have also been active (Chart 3). Overall, the Grade A office availability rate rose slightly by 0.2 percentage points q-o-q to 13.8%.

John Siu, Managing Director, Head of Project and Occupier Services, Hong Kong, Cushman & Wakefield stated, "Several large-scale office projects in non-core districts are expected to complete in H2 2022, providing a total floor area of 2.5 million sq ft to the Grade A office market. The upcoming supply will likely attract expansion, upgrading, relocation and cost-saving opportunities, prompting the decentralization trend to continue. In terms of new leasing activity, besides major movers such as banking and finance, and the professional services and real estate sectors, we have observed a sizeable number of new transactions conducted by the healthcare and medical aesthetics sector, which took 5.2% of the newly leased space in Q2. Serviced offices and co-working space operators have also continued to expand. We believe this new emerging demand will boost absorption of the new upcoming supply, while we expect overall availability to reach 16% to 17% by the end of this year."

Retail market – Attractive rents as F&B operators are proactive in the leasing market

The city's retail market remained relatively weak in Q2 2022, with total retail sales for January to May falling by 2.9% y-o-y. On a y-o-y basis, the Fashion & Accessories and Jewellery & Watches sectors recorded the steepest falls, while daily necessities such as Medicines & Cosmetics and Supermarkets sectors recorded increases (Chart 4). Nevertheless, the vacancy rate in core retail sub-markets fell or remained stable across the board. For example, Causeway Bay dropped to 7.9%, a return to the benchmark figure of the end of 2021, while Mongkok fell to 12.7% in Q2 from 16.4% in Q1.

With the pandemic gradually brought under control in the city, retail consumers have started to pick up in spending momentum" Retail rents in major districts have generally stabilized, with Central and Mongkok rising by 0.1% q-o-q and 0.6% q-o-q. In other districts, rental declines were minor, ranging between 0.2% q-o-q and 1.3% q-o-q. Benefitting from the further relaxation of dining restrictions, previously pressured F&B rents demonstrated promising signs of rental recovery in various submarkets, in a range of 0.6% q-o-q to 1.5% q-o-q (Chart 5), while rents in Central remained unchanged.

Kevin Lam, Executive Director, Head of Retail Services, Agency & Management, Hong Kong, Cushman & Wakefield stated, "F&B operators have been relatively proactive in expanding this quarter. With F&B rents remaining at attractive levels, coupled with the next round of the Consumption Voucher program soon to be issued, and new government leadership, F&B operators have turned more optimistic and have taken up space in high-end core districts to increase their brand exposure and positioning. We believe leasing activities will likely become more active, with some high street rents expected to reach between 3% to 5% growth, while we expect overall retail and F&B rents to rise by 1% to 5% in 2H 2022, offsetting the fall in the first half, and gradually entering a state of stability.

Kevin Lam added, "The effects of the pandemic have prompted people to prioritize their health and mental well-being. Travel restrictions such as the continuing quarantine controls have also shifted consumers' spending habits towards domestic spending. In addition to the traditional retail and F&B sectors, the lifestyle products, wellness and sports sectors such as indoor climbing centers have continued to become a driving force and a anchor of the retail market as a result of their expansion and space requirements."

Please click here to download photos.

Hashtag: #Cushman&Wakefield

About Cushman & Wakefield

Cushman & Wakefield (NYSE: CWK) is a leading global real estate services firm that delivers exceptional value for real estate occupiers and owners. Cushman & Wakefield is among the largest real estate services firms with approximately 50,000 employees in over 400 offices and 60 countries. Across Greater China, 22 offices are servicing the local market. The company won four of the top awards in the Euromoney Survey 2017, 2018 and 2020 in the categories of Overall, Agency Letting/Sales, Valuation and Research in China. In 2021, the firm had revenue of $9.4 billion across core services of property, facilities and project management, leasing, capital markets, valuation and other services. To learn more, visit www.cushmanwakefield.com.hk or follow us on LinkedIn ( https://www.linkedin.com/company/cushman-&-wakefield-greater-china).