BNM has left its base rate unchanged: Octa broker analyses the decision

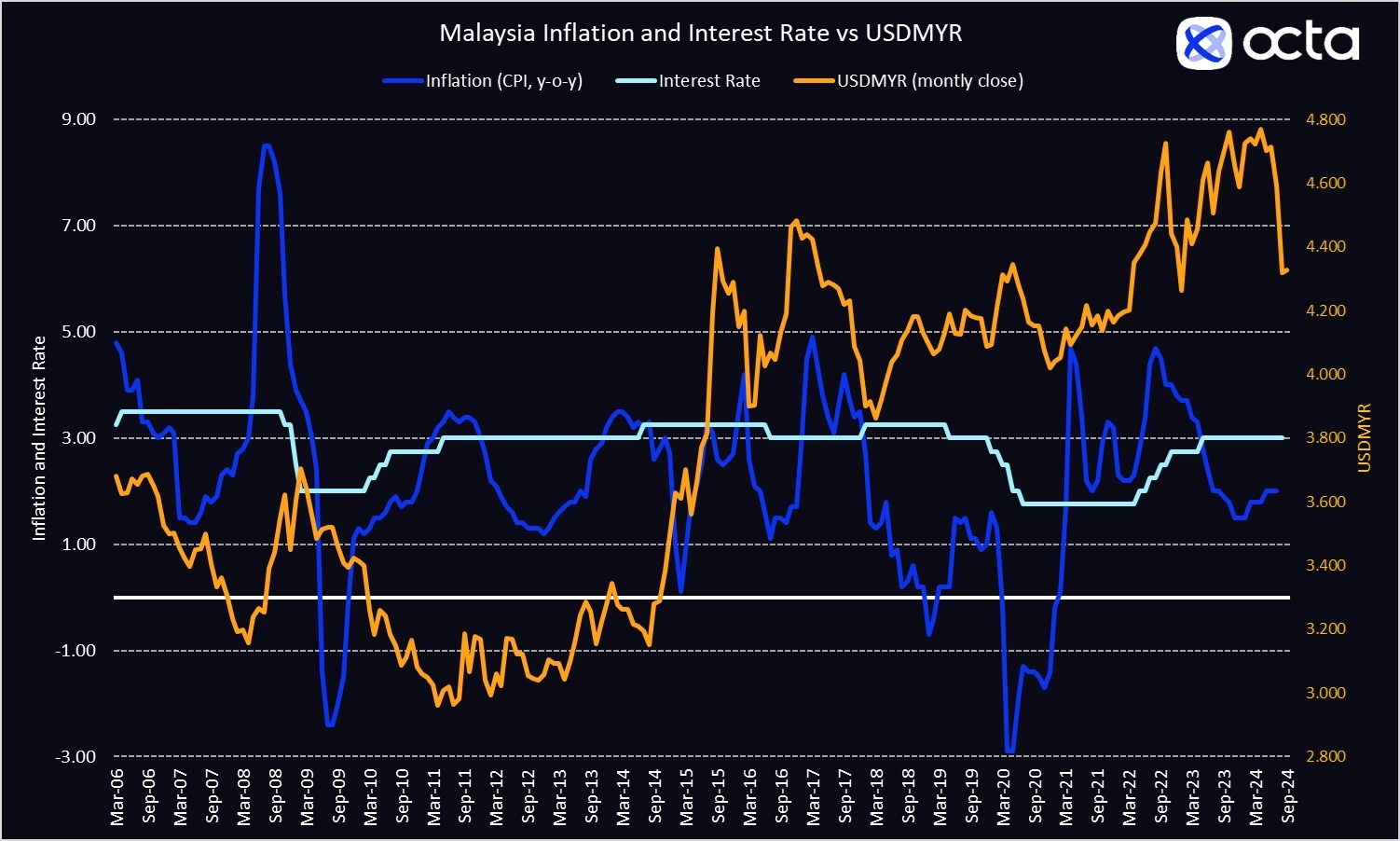

KUALA LUMPUR, MALAYSIA - Media OutReach Newswire - 13 September 2024 - The Malaysian economy is growing faster than expected, and the local currency has appreciated quite noticeably. However, the central bank has maintained the interest rate at 3.00%, in accordance with the economists' expectations.

Still, Octa analysts expect that the BNM may soon lower the rates.

Bank Negara Malaysia (BNM), Malaysia's central bank, announced its policy rate decision on Thursday, 5 September. Like most central banks worldwide, BNM strives to balance low inflation and sustainable economic growth. Its key monetary policy instrument is the Overnight Policy Rate (OPR). By adjusting the OPR, BNM influences interest rates throughout the Malaysian economy, impacting borrowing costs for businesses and consumers and ultimately influencing economic activity and inflation.

It was a difficult decision for the central bank to maintain the interest rate at its current level. The bank is trying to strike a delicate balance between a strong economy and potentially incendiary inflation on the one hand and a dovish Federal Reserve (Fed) and appreciating ringgit on the other. According to the latest data published on 16 August, the annual growth rate of the gross domestic product (GDP) accelerated to 5.9% in Q2 2024, its fastest pace in 18 months. Economic growth for 2024 is expected to exceed the central bank's forecast of 4-5%, driven by a continued increase in consumer spending and a recovery in exports. 'Lowering borrowing costs when the economy is expanding risks spurring inflation, especially given that the government continues to gradually phase out subsidies programs,' says Kar Yong Ang, a financial market analyst at Octa broker. However, inflation seems to have stabilised lately. Malaysia's consumer price index (CPI) rose 2.0% in July from a year earlier, matching the increases of the previous two months. Furthermore, the rise was slightly less than the 2.1% increase forecast in a Reuters poll.

Meanwhile, the Malaysian ringgit has strengthened against the US dollar, significantly reducing import prices. Indeed, Octa analysts expect Malaysian inflation to remain low in Q4 due to strong ringgit. At the same time, many countries are gradually reducing or have already reduced interest rates. The BNM's decision to keep the rates unchanged is somewhat controversial. 'It was a tough decision to make,' argues Kar Yong Ang. 'BNM is probably thinking about how and when to cut the rate so that it does not fall far behind other central banks––especially the Fed. However, the BNM did not choose to lower rates ahead of the Fed. A sharp fall in USDMYR supports the case for a rate cut later this year as inflation risks seem to be well-anchored at this point.'

Still, a recent Reuters poll of economists expects the BNM to maintain interest rates at their current levels until the end of 2026.

'As we expected, BNM held the rates unchanged, but the likelihood of a reduction in the near term has increased,' says Kar Yong Ang, adding that future decisions will largely depend on what the Fed does and on the overall economic conditions in the global market. In particular, the appreciation of the domestic currency, which is currently taking place, has a negative impact on exports but also helps push inflation down. There is also a trend towards lower interest rates, followed by other countries in the region––notably, the Reserve Bank of New Zealand (RBNZ) and the Central Bank of the Philippines have lowered rates in recent weeks.

'We anticipate a decrease in the interest rate either this year or in Q1,' said Kar Yong Ang. Octa analysts expect USDMYR to drop below 4.250 in the near term.

Hashtag: #Octa

The issuer is solely responsible for the content of this announcement.

Octa

Octa is an international broker that has been providing online trading services worldwide since 2011. It offers commission-free access to financial markets and various services used by clients from 180 countries who have opened more than 52 million trading accounts. To help its clients reach their investment goals, Octa offers free educational webinars, articles, and analytical tools.

The company is involved in a comprehensive network of charitable and humanitarian initiatives, including the improvement of educational infrastructure and short-notice relief projects supporting local communities.

In the APAC region, Octa received the ‘Best Trading Platform Malaysia 2024’ and the ‘Most Reliable Broker Asia 2023’ awards from Brands and Business Magazine and International Global Forex Awards, respectively.