Young people want it all – financial freedom and time to enjoy life

Prudential poll shows that Gen Zs and Millennials define financial success as more than just affluence, with 76 per cent aiming for financial freedom, and 65 per cent seeking work-life balance

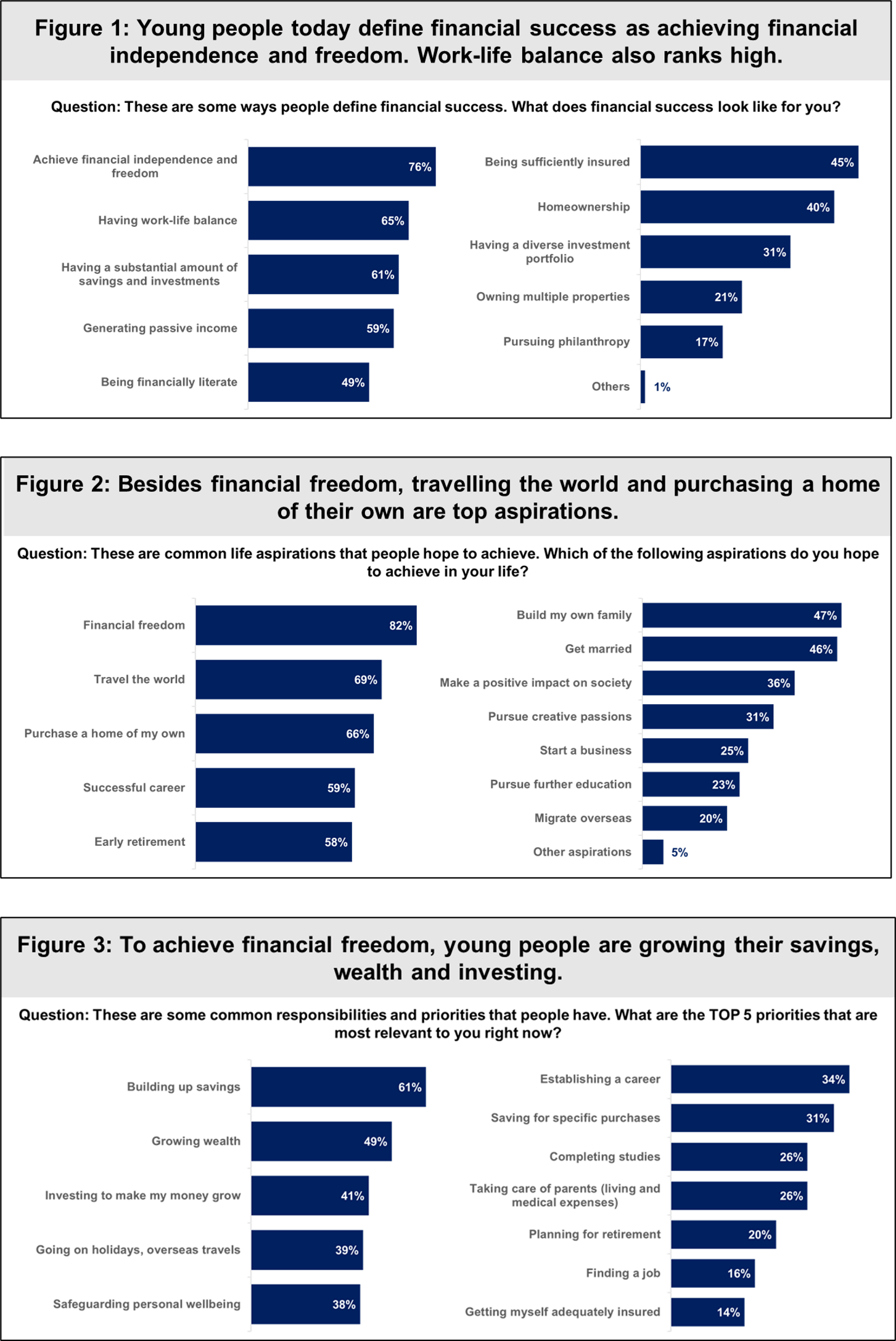

SINGAPORE - Media OutReach - 23 August 2023 - Young people today have a more holistic view of financial success compared to yesteryears when the traditional "5Cs"[1] were symbolic of having made it in life. More than three in four (76 per cent) Gen Zs and Millennials say that financial success for them means enjoying the financial freedom to pursue the lifestyle that they desire and to be free from financial concerns (Figure 1). This is according to a poll commissioned by Prudential Singapore ("Prudential") which explores the priorities, aspirations and goals of Singapore residents aged 16 to 29 who have just started their careers.Work-life balance also came up as an important definition of financial success for 65 per cent of the 1,000 respondents surveyed. This shows that while being financially secure is important, young people also want a fulfilling life that includes time for aspirations such as travelling the world, giving back to society (Figure 2), and prioritising their personal wellbeing (Figure 3).

Work-life balance being a priority also suggests that young people don't see hustling (putting work above all else) as their main strategy to achieving financial success. Instead, they are looking to grow their wealth through other sources such as investments and passive income, so that they have more time to live life to the fullest. More than half (58 per cent) said that they would like to retire early (Figure 2).

Mr Ben Tan, Chief Corporate Development Officer, Prudential Singapore, said: "Owning the '5Cs' including material assets such as a car or condominium used to be the measure of whether one has made it in life. According to our study, this definition has broadened with young people today having a more holistic view of success. They want to achieve financial freedom, and for them, this means having it all – wealth as well as the time to spend with their loved ones and on their personal passions and wellness.

"We are leading longer lives and living costs are increasing. Therefore, taking steps to achieve financial freedom early in one's career is important as this gives you a longer runway to prepare for milestones such as buying a home, starting a family and retirement. Building financial literacy early is also crucial as it sets the foundation for a healthy financial future."

How young people are working towards financial freedom

According to the Prudential poll, young people are prioritising building up savings (61 per cent), growing wealth (49 per cent), and investing to make their money grow (41 per cent). However, planning for retirement and being adequately insured are not as high on their list, with less than one in five choosing them as priorities (Figure 3).

Commenting on the importance of having sufficient protection, Mr Tan said: "Insurance is an important component of financial and retirement planning as it not only provides protection for you and your family, but also helps to build your wealth and cushion the impact of inflation. If you are adequately insured when you are young and healthy, you can achieve financial freedom as you pursue your life goals with peace of mind knowing you are well-protected against unexpected life events."

About the poll

This poll was commissioned by Prudential and conducted by Milieu Insight and surveyed 1,000 Singaporean residents aged 16 to 29 who are still studying or working. Responses for the online poll were collected in July 2023.

Hashtag: #PrudentialSingapore

https://sg.linkedin.com/company/prudential-assurance-company-singapore

https://www.facebook.com/PrudentialSingapore/

https://www.instagram.com/prudentialsingapore/?hl=en

The issuer is solely responsible for the content of this announcement.

About Prudential Assurance Company Singapore (Pte) Ltd (Prudential Singapore)

Prudential Assurance Company Singapore (Pte) Ltd is one of the top life insurance companies in Singapore, serving the financial and protection needs of the country's citizens for 92 years. The company has an AA- Financial Strength Rating from leading credit rating agency Standard & Poor's, with S$49.4 billion funds under management as at 31 December 2022. It delivers a suite of well-rounded product offerings in Protection, Savings and Investment through multiple distribution channels including a network of more than 5,000 financial consultants.