Christmas bonus: Finder Earn ups rate to 6.01% p.a. until November

- Written by The Times

Aussie households have been given an opportunity to earn more on their capital to turbocharge their Christmas cushion.

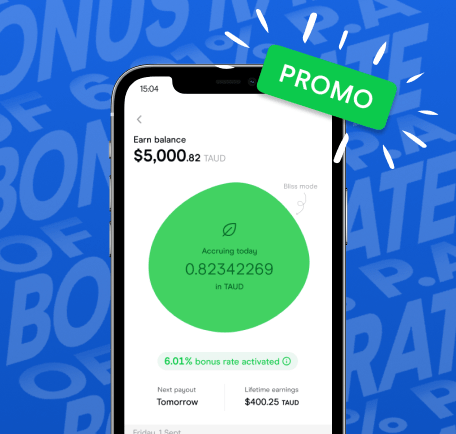

Leading fintech Finder has added a bonus 2% p.a. – on top of an already attractive 4.01% p.a. – for those with more than 5,000 TAUD in their Finder Earn account during September and October.

That's 391 TAUD Aussies could earn in 2 months based on a Finder Earn Balance of 39,439 TAUD – equivalent to the AUD amount the average Australian has in savings according to Finder research.

The announcement comes as Aussies struggling with rising inflation and interest rates look for ways to increase their capital.

Finder Earn launched in November 2021 and has grown steadily with over 300,000 TAUD (equivalent to over $300,000) in earnings paid out to date.

To use Finder Earn, a member converts Australian dollars (AUD) into TAUD stablecoins at an exchange rate of 1 AUD = 1 TAUD. These TAUD stablecoins are then lent to Finder.

In exchange for lending Finder capital in the form of TAUD stablecoins, Finder pays a base rate of 4.01% p.a., which is paid out daily. On top of this, Finder is offering a 2% bonus rate for deposits of TAUD 5,000 or above.

Angus Kidman, Finder’s editor-at-large, said Finder Earn makes crypto assets more accessible to everyday Australians.

“Aussies are increasingly looking for ways to fire up the returns on their capital as the cost of living takes a bigger bite out of paycheques,” he said.

“Although interest rates are rising, the prices consumers must pay for goods and services are rising faster.

“We established Finder Earn as a way to take digital assets from niche to mainstream – it’s a prime way for Australians to earn a return.

“Earning 6.01% p.a. on any asset class is an achievement, especially one where you can withdraw at any time with no fees,” he said.

Based on the 4.01% p.a. Finder Earn model, if someone were to allocate 20,000 TAUD in Finder Earn, they’d earn 66 TAUD a month and 818 TAUD per year.

With the bonus rate of 6.01% p.a. – 20,000 TAUD would return 198 TAUD during September and October alone.

Kidman said now is the time for Aussies to realise the benefits digital assets can unlock.

“Our mission is to help people make better financial decisions and to save and grow their money.

“The soaring cost of living is wreaking havoc on Christmas budgets – now is the perfect time to bring in some good news in time for the festive season.”

Finder Wallet is a digital currency exchange registered with AUSTRAC.

The bonus rate is available until 1 November 2022 for those with more than 5,000 TAUD in Finder Earn.

The Finder app is free and available to download in both the App Store and Google Play Store.