OneHypernet extends wholesale FX rates to SMEs

SINGAPORE - Media OutReach - 22 March 2023 - OneHypernet, a money transfer network that connects financial institutions for foreign exchange (FX) payments, has announced that small and medium-sized enterprises (SMEs) can now access wholesale FX rates for their money transfers / remittances.

In addition, SMEs receive cashback on their transactions. OneHypernet offers price matching via WhatsApp, ensuring that SMEs get the best possible rates.

SMEs are often misled by money transfer pricing

Comparing the cost of money transfers can be tricky because providers present their FX rates and fees differently. Some charge variable fees, some charge fixed fees, and some simply present an FX rate that includes a mark-up.

This makes a like-for-like comparison of FX rates and fees difficult. Instead of comparing fees or FX rates, SMEs should consider the foreign currency amount that needs to be transferred, then compare the final payment in their local currency (net of any fees and cashback).

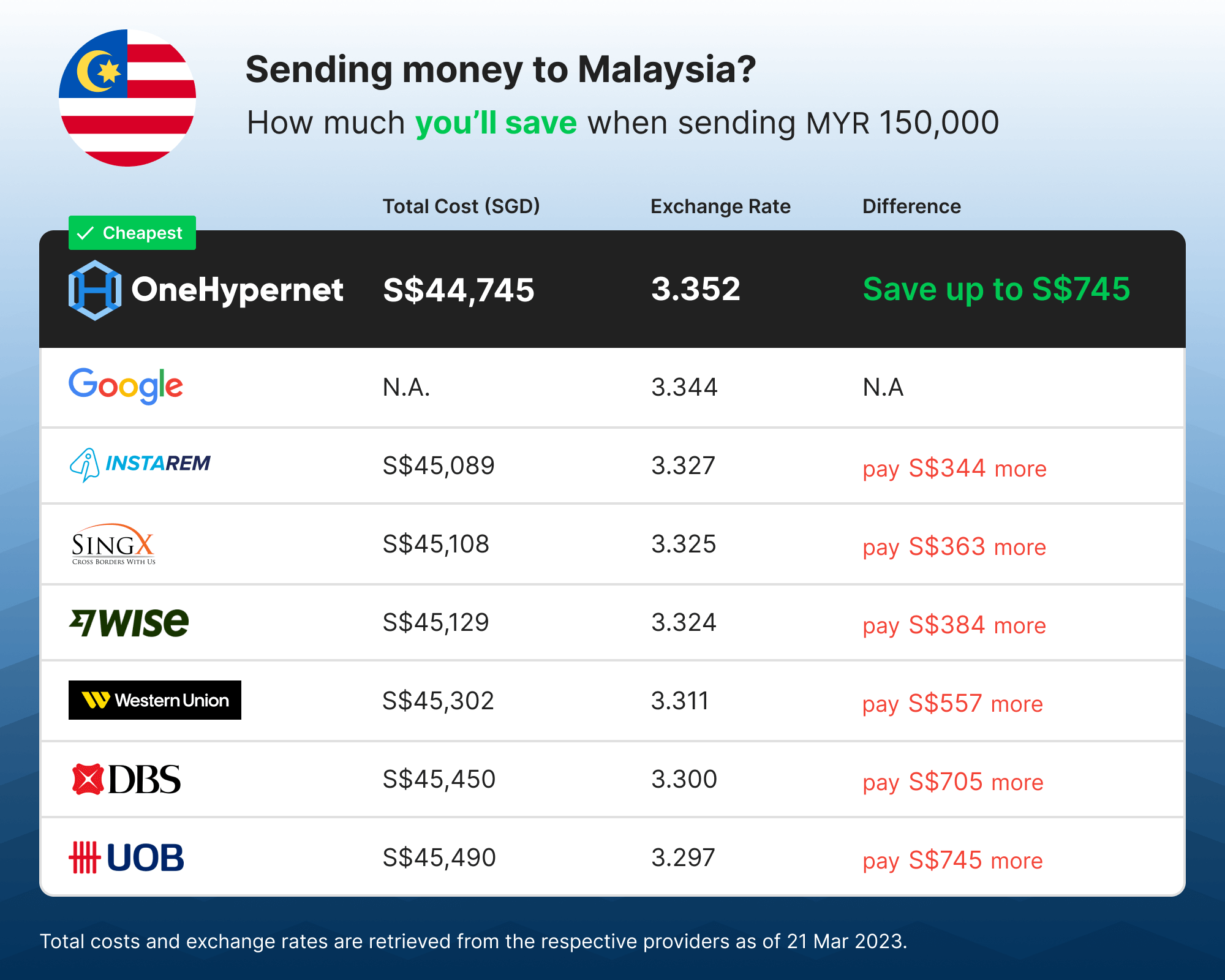

For example, for a Singapore based SME that is making a payment of MYR 150,000 to Malaysia, the comparison should be made between the final cost in SGD of executing this payment via the different providers.

The interbank / mid-market or "Google" rate may not be the best rate

Many providers claim to offer transparent pricing by charging a variable fee on top of the interbank rate. However, SMEs should be mindful that this can also be misleading.

For example, if the provider offers a mark-up of 0.50% over the interbank rate, the SME may believe that their "cost" is only 0.50%, because interbank rates are mistakenly used as a proxy for the best possible FX rate.

This is not always the case because money transfer rates can often be better than interbank rates, sometimes by as much as 3%. In this example, if the SME had used a platform with a better FX rate, they could have saved 3.5% on their money transfer, or S$1,575 for a typical SME remittance of SGD 45,000.

Save more with OneHypernet

OneHypernet conducted a comparison of the cost of sending MYR 150,000 on 21 Mar 2023 from popular providers in Singapore. The results showed that SMEs using OneHypernet for their remittances can save up to S$745 for this transaction.

Signing up for a OneHypernet account is free and takes less than a minute via Myinfo / Singpass. For more information, please visit www.onehypernet.com

Hashtag: #OneHypernet #FX #moneytransfer #remittance #SME #MYR #inflation

https://sg.linkedin.com/company/onehypernet

The issuer is solely responsible for the content of this announcement.

OneHypernet

OneHypernet connects the world's foreign exchange markets on a unified ecosystem powered by enterprise blockchain technology, and has been awarded the Monetary Authority of Singapore (MAS)'s Financial Sector Technology and Innovation (FSTI) Proof of Concept (POC) grant.