Zoho Launches Zoho Books Singapore edition

Helping businesses ensure e-invoicing compliance and improved accuracy in their GST filing

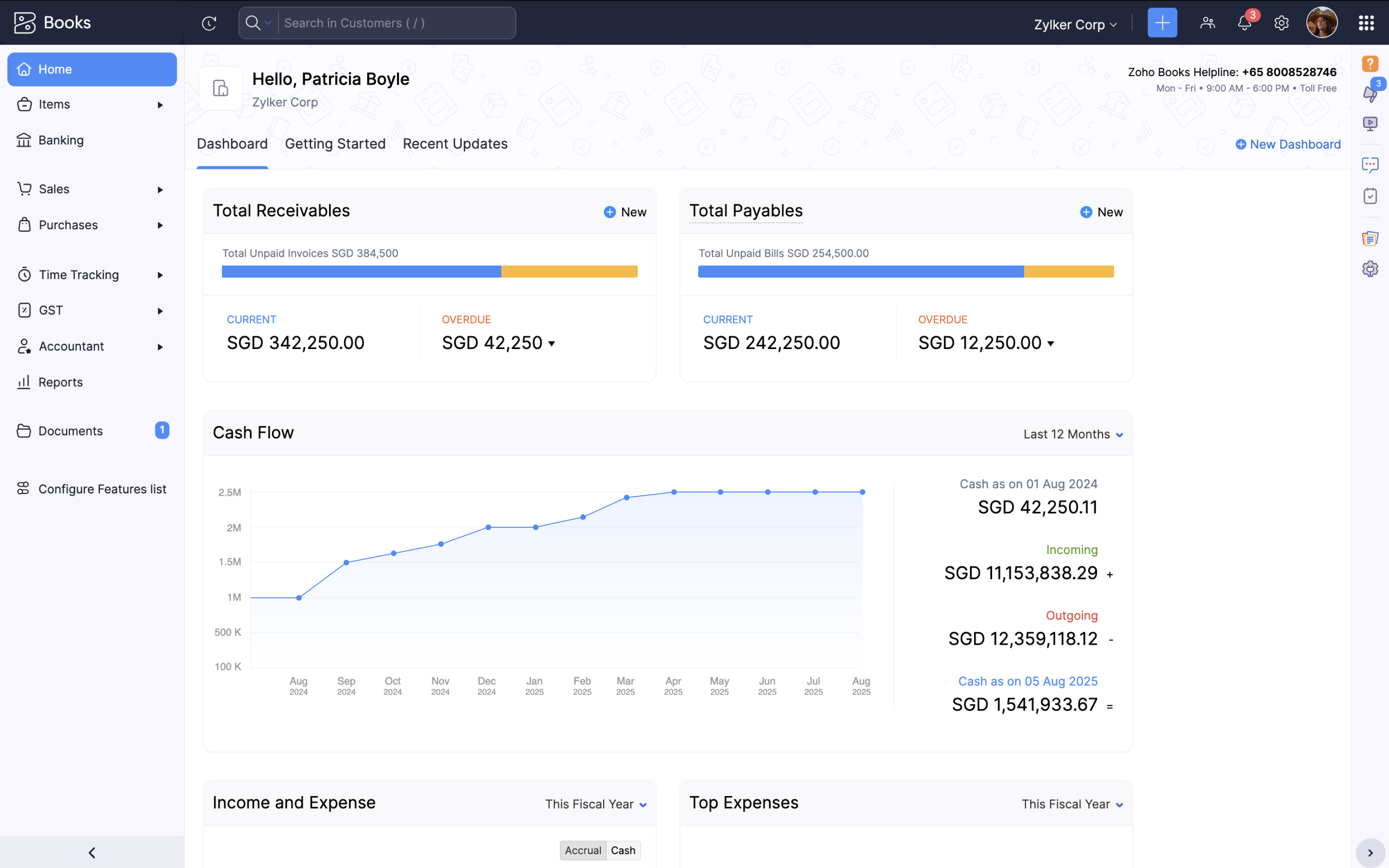

SINGAPORE - Media OutReach Newswire - 6 August 2025 - Zoho Corporation, a global technology company, today launched the Singapore edition of Zoho Books, cloud-based accounting software to help businesses simplify GST and e-invoicing compliance.This launch includes the Singapore edition of other solutions in Zoho's finance and operations suite of applications, offering businesses a better way to manage their financial and operational processes while staying compliant with the country's regulations.

"The launch of the Singapore edition of Zoho Books represents a significant step forward in enabling businesses and accountants to embrace digital transformation in financial compliance. With built-in AI capabilities and automation, Zoho Books simplifies GST calculations, ensures adherence to IRAS regulations, and helps mitigate compliance risks. As part of our 16+ country-specific editions, this launch empowers organisations to improve accuracy, reduce manual effort, and navigate an increasingly complex regulatory environment," says Gibu Mathew, VP and GM, Zoho APAC

According to a recent survey by Zoho, a majority of businesses in Singapore report managing GST compliance efficiently, with 82% finding IRAS guidance easy to follow. However, challenges remain, 32% of businesses still file manually through the IRAS portal, and 71% spend up to five days preparing GST returns. The most common difficulties cited were: staying updated with regulatory changes, accurately calculating input/output tax, and ensuring timely filing.

These insights point to a growing need for automation in tax compliance. Zoho Books addresses this by providing real-time updates on GST regulations, automating tax calculations, and generating IRAS-ready F5 returns. By reducing manual processes, the solution helps businesses improve accuracy, save time, and minimise compliance risks. This is particularly relevant in light of recent enforcement trends. In FY23/24, the Inland Revenue Authority of Singapore (IRAS) recovered $162 million, including penalties, through over 2,500 audits across industries. A significant portion of these penalties stemmed from compliance lapses, highlighting the importance of adopting reliable, audit-ready systems like Zoho Books.

Zoho Books offers e-invoicing compliance which provides B2B businesses the ability to send invoices electronically directly into their accounting systems according to the PEPPOL standards. Zoho Books will soon offer integration with InvoiceNow to push invoices to the IRAS. With this accounting solution, businesses can also manage their finance end-to-end, perform core accounting functions, track stocks, reconcile bank accounts, and manage projects. The software offers PayNow payment method to streamline payment collections. With AI-driven receipt capture, businesses can automatically record expenses and bills within the application. Zoho Books also comes with other advanced capabilities like audit trail, order management, budgeting and workflow automation. With the application's built-in Zoho Analytics integration, businesses can leverage Zia, Zoho's AI-based analytics assistant to track financial trends with smart visualizations, perform predictive analysis and make data-driven decisions.

The Singapore edition of other solutions in Zoho's finance and operations suite offers the following capabilities:

- Zoho Inventory, a comprehensive solution to manage inventory, track stock levels, and generate GST and e-invoicing compliant invoices, ensuring seamless integration with shipping carriers and aggregators like Singapore Post, and Easyship for efficient order fulfilment. The solution offers advanced warehouse management capabilities and provides faster order processing. Businesses can leverage location tracking and labelling, stock counting, stock out alerts, and role-based access to the warehouse operations for better inventory control.

- Zoho Billing is a versatile billing platform, offering one-time billing, subscription management, with GST and e-invoicing compliance, along with AR automation capabilities. The solution offers project billing, Quote-to-Cash (Q2C) and revenue reporting functionalities. Additionally, Zoho Billing offers subscription management capabilities like trial management, prorated billing, usage billing, customer lifecycle management, and retention.

- Zoho Invoice is a free invoicing solution built for small businesses that helps manage receivables. Businesses can send quotes and create customised, GST compliant invoices.

- Zoho Expense, end-to-end travel and expense (T&E) management software, that provides businesses with capabilities to manage all stages of employee travel, and automate expense reporting. With self-booking capabilities, employees can book flights, hotels, taxis, and trains according to company policy, reducing administration. Per diem rates and rules can be auto-imported, compliant with government regulations, automating business travel allowances.

- Zoho Commerce, a complete e-commerce platform that helps businesses create and manage online stores, accept orders, send GST-compliant invoices, process payments, manage shipping and track inventory. With Zoho Commerce, businesses can easily set up an online presence without needing any coding expertise.

- Zoho Practice is built for accounting professionals, helping them deliver client services efficiently. Workpapers simplifies audit and compliance workflows by automatically fetching client financial statements from Zoho Books, enabling easy comparison, adjustments, document management, and collaboration for seamless review and approval. The self-service portal enables accountants to collaborate with clients that use third-party services, facilitating document requests, digital signatures, and communication.

Powerful Platform

Zoho's finance suite of applications is built on the same platform, enabling instant interoperability and contextual data flow between applications, resulting in improved data accuracy and saved productive hours in manually re-entering data. Bringing 15+ years of experience and innovation, the finance and operations suite provides 16 country-specific editions tailored for local tax and compliance needs, including Singapore, UK, India, and the UAE. The platform offers advanced capabilities, using which businesses can easily customize, scale, and extend the applications according to their requirements. This significantly reduces the need to invest in IT resources and quickly go to market with any change.

Pricing and Availability

All products are available for immediate use. The pricing of Zoho Books starts at S$18 per month, per organization. The application also offers a free plan.

For more details on pricing, please visit the following pages for each product:

Zoho Books, Zoho Inventory, Zoho Billing, Zoho Expense, Zoho Commerce, and Zoho Practice.Hashtag: #zoho #zohobooks #singapore

https://www.zoho.com

https://www.linkedin.com/company/zohoapac

The issuer is solely responsible for the content of this announcement.

Zoho Corporation

With 55+ apps in nearly every major business category, Zoho Corporation is one of the world's most prolific technology companies. Zoho is privately held and profitable with more than 18,000 employees globally with headquarters in Austin, Texas and international headquarters in Chennai, India. Zoho APAC HQ is located in Singapore. For more information, please visit: www.zoho.com/

Zoho respects user privacy and does not have an ad-revenue model in any part of its business, including its free products. The company owns and operates its data centers, ensuring complete oversight of customer data, privacy, and security. More than 120 million users around the world, across hundreds of thousands of companies, rely on Zoho everyday to run their businesses, including Zoho itself. For more information, please visit: https://www.zoho.com/privacy-commitment.html