Octa Broker: Malaysia's BNM May deliver a surprise rate cut

KUALA LUMPUR, MALAYSIA - Media OutReach Newswire - 7 July 2025 - This Wednesday, Bank Negara Malaysia (BNM) will announce its policy rate decision. While most analysts expect Malaysia's central bank to keep the rate unchanged, Octa Broker suggests a surprise rate cut is possible due to subdued inflation, strong ringgit, and a high probability for Federal Reserve(Fed) rate cuts later this year.

On Wednesday, 9 July, Bank Negara Malaysia (BNM), the nation's central bank, will reveal its policy rate decision. Like most other central banks around the world, BNM strives to maintain a balance between low inflation and sustainable economic growth. Its key monetary policy instrument is the Overnight Policy Rate (OPR). By adjusting the OPR, BNM influences interest rates throughout the Malaysian economy, impacting borrowing costs for businesses and consumers and ultimately influencing economic activity and inflation.

Although Malaysia's Gross Domestic Product (GDP) expanded at a solid 4.4% annual rate in Q1 2025, it was slower than during the previous quarter and below the 4.5% expansion rate expected by the market. At his press conference in May, Abdul Rasheed, the BNM Governor, stressed that growth in major trading partners due to trade restrictions would affect spending and investment activities in Malaysia and said that 'the balance of risk to the growth outlook is currently tilted to the downside'. Indeed, the most recent economic data has consistently underperformed expectations over the past several months, raising concerns regarding the future trajectory of the Malaysian economy.

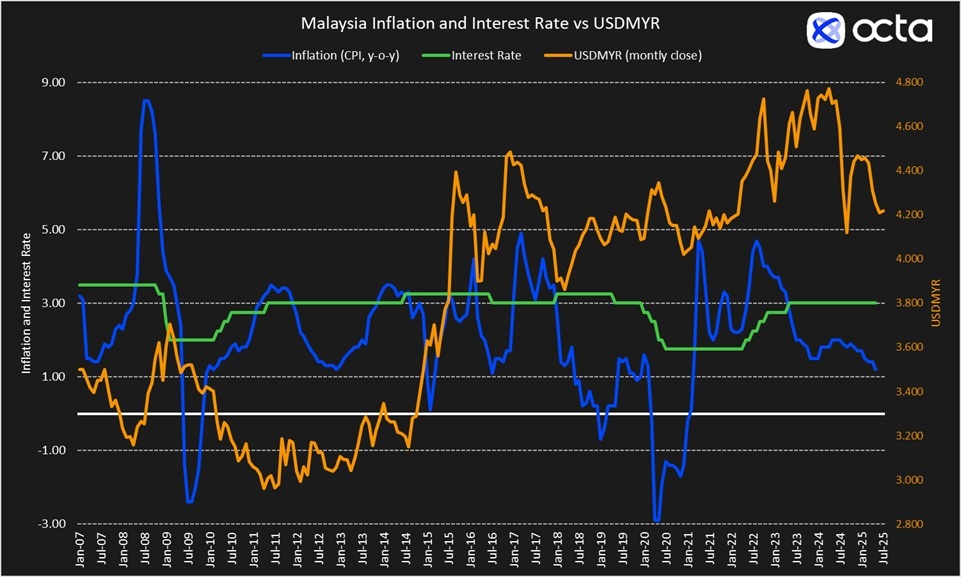

In April, Malaysia's industrial production saw only a 2.7% increase year-over-year (y-o-y), substantially below the 3.9% expansion rate expected by the market. In May, the country experienced an unexpected 1.1% annual decline in exports, primarily due to reduced shipments of petroleum products, chemicals, iron, and steel. This contrasted sharply with economists' predictions of a 7.5% export growth. Consequently, Malaysia's trade surplus for May was significantly lower than anticipated, reaching only 0.8 billion ringgit (MYR). Most importantly, Malaysia's consumer price index (CPI) rose just 1.2% y-o-y in May, less than the 1.4% increase forecast by the market.

'BNM's upcoming policy rate decision arrives on the back of rather disappointing data prints', says Kar Yong Ang, a financial market analyst at Octa Broker. ‘With inflation at four-year low and exports slowing sharply to the point of almost pushing the trade balance into the negative territory, I do not think BNM can afford to keep the rates at 3.00% for much longer. BNM is actually well-positioned to act now. Slowing inflation provides room for a rate cut, while slowing exports and external growth uncertainties provide a good reason for it'.

Although it is relatively uncommon for central banks to make surprise policy rate decisions so as not to unnerve the markets, BNM is facing substantial external pressure to act preemptively. Starting from July 9, Malaysian exports to the U.S. will be subject to a 24% tariff, unless a successful negotiation for a lower rate can be achieved. There has been little progress on that front lately. Moreover, USDMYR has dropped by almost 13% since April last year and risks falling further as investors’ monetary policy expectations regarding the U.S. central bank remain decidedly dovish. Indeed, traders are currently pricing in a 72% chance of a rate cut by the Fed in September. Meanwhile, the latest interest rates swaps market data factors in a roughly 33% probability that the Fed’s rate will decline by 75 basis points (bps) to 3.50-3.75% by the end of the year, substantially reducing the interest rate differential between the U.S. and Malaysia. This will likely exert an additional bearish pressure on USDMYR, potentially hurting Malaysian exports even further.

Kar Yong Ang concludes: 'While global investors might be overly optimistic regarding the Fed's propensity for rate cuts, Malaysia still faces significant external growth challenges regardless of relative monetary policy stances. The global economy will almost certainly slow down due to U.S. tariffs, and given Malaysia's openness as an export-oriented economy, it is highly vulnerable to the resulting downturn in global trade and weaker demand from major trading partners, alongside the direct impact of the tariffs on its own exports'.

On balance, as the BNM will be announcing its policy rate decision amidst growing external pressures and a string of disappointing economic reports, the chances for a surprise rate cut have increased considerably. Octa broker analysts believe that subdued inflation allows for a rate cut, while slowing exports and external growth uncertainties provide a good reason for it. Indeed, the looming 24% U.S. tariff on Malaysian exports and ostensibly dovish Fed further complicates the outlook and underscores the need for preemptive action to mitigate downside risks.

___

Disclaimer: This press release does not contain or constitute investment advice or recommendations and does not consider your investment objectives, financial situation, or needs. Any actions taken based on this content are at your sole discretion and risk—Octa does not accept any liability for any resulting losses or consequences.

Hashtag: #Octa

The issuer is solely responsible for the content of this announcement.

Octa

Octa is an international CFD broker that has been providing online trading services worldwide since 2011. It offers commission-free access to financial markets and various services used by clients from 180 countries who have opened more than 52 million trading accounts. To help its clients reach their investment goals, Octa offers free educational webinars, articles, and analytical tools.